Protect Your Assets And Financial Future

There are many reasons individuals and business owners may find themselves in a financial bind with mounting high debt. The best course of action to alleviate the stress, protect your assets and safeguard your future financial stability is going to be dependent on the nature of your debt, your current financial circumstances and your goals. While the law provides a means of releasing your obligation to pay some debts through filing bankruptcy, not everyone qualifies to file for debt relief through Chapter 7 bankruptcy.

Even if you are embarrassed about how you have handled your finances in the past, you will have to be honest about the nature of your debt, your current financial situation and your future objectives. There is no reason to be ashamed. There is every reason to be candid with me, so I can help you move forward and get a fresh start.

If you have filed for bankruptcy less than eight years ago, you will have to find a different path to debt relief than Chapter 7. But you are eligible to file for Chapter 13 four years after filing for Chapter 7. If you do qualify to file for one of several chapters of bankruptcy, you may still have to pay back some of your debt within a set period of time. There are several paths from which to choose, and I can help you determine which one may be in your best interests.

I also offer my services for creditor representation in cases where an ex-spouse or an individual lender has interests to protect in a bankruptcy filing. It is essential to keep in mind that there is a short time to take action to protect those rights if you are a creditor.

Trusted Bankruptcy And Debt Relief Lawyer Serving Clients Throughout Maine For More Than 15 Years

Our Practice Areas

Transparent Communication Knowledgeable Legal Advocacy And Low Fees

My practice of law is exclusively concentrated on debt relief. Because I do this every day, there are fewer overhead costs. Other law firms may divide work between associates and staff, but at Law Office of J. Scott Logan, LLC, you will speak directly with me from start to finish. When potential clients call for a free confidential consultation, they can be assured that they will meet with me and not a less experienced assistant. We will discuss all of the options available, whether you are facing a foreclosure, consumer law issue, or debt management.

I understand the toll that financial distress can take on your life and your family relationships. I will help you balance your options whether you are seeking a loan modification, mediating a foreclosure, pursuing debt settlement or considering filing for Chapter 7, 11, 12 or 13 bankruptcy. When there are court hearings, I will be the lawyer attending them and do my very best to answer all emails and calls personally. I find that having one person follow a case from start to finish gives my clients a sense of security and confidence despite dealing with a stressful situation.

A Competent Attorney To Guide You Through Business Decisions

As most Americans know, this country continues struggling through one financial crisis after another. With record numbers of foreclosures in Maine, bankruptcy is just a business decision, and a competent attorney who prioritizes meticulous attention to detail is necessary to guide you through this decision with solid legal guidance.

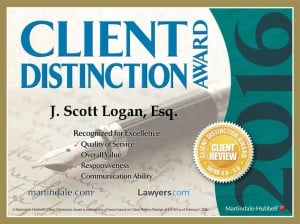

I have been recognized by my legal peers for my commitment and excellence in the field of bankruptcy as a Super Lawyers Rising Star 2015-2017. Candidates for this accolade must be under the age of 40 or practicing in their field of law for under 10 years. Fewer than 2.5% of bankruptcy lawyers in Maine receive this recognition annually.

My firm continues to grow by client and attorney referrals. For a free consultation to discuss your debt relief options, call my office in Portland at 207-613-8590 or send me an email to initiate a consultation.

Answers To Frequently Asked Questions

What Does Filing Bankruptcy Cost?

My fees range depending upon the complexity of your case. My fees can range from $1,000 to $1,800, but are usually around $1,799 inclusive of court filing fees, credit counseling fees and credit reports. Chapter 13 cases involve additional fees paid through your monthly plan payments. While we cannot file a case until the whole amount is received (seeking payment after you file violates the law), we can accept payment plans and you can refer creditors to us once we receive a portion of the balance.

Will Everyone Know If I File?

No. Bankruptcy is technically a public process and your newspaper could report it. However, it has been several decades since newspapers in Southern Maine or Central Maine, have reported them in all but celebrity cases. In all likelihood, the only people who will learn of your bankruptcy are your creditors, the trustee, and other people attending their own meetings with the trustee the same time as yours.

Will I Lose My House Or Car In Bankruptcy?

Most people don’t lose their house or car in bankruptcy if they are current on the payments and can make payments in the future. Under the Maine exceptions, an individual can protect between $80,000 and $160,000 in value above the debt in his or her residence. Individuals can protect up to $10,000 of value in one motor vehicle. A married couple could protect $100,000 in their home and $10,000 each in two cars. If there were excess value, a Chapter 13 reorganization offers the time to pay that value over up to five years. If you cannot afford to make ongoing payments, you may surrender the property and you won’t owe the creditor anything afterwards. You can also protect up to $3,500 in cash or bank accounts.

Will A Bankruptcy Get Rid Of All My Debt?

No. Chapter 7 bankruptcy does not normally discharge student loans, recently filed or unfiled tax obligations, trust fund or employee taxes or debts pursuant to a divorce decree. Creditors rarely bring lawsuits to prevent debts from being discharged if incurred through things like fraud or willful personal injury. In some instances, a separate lawsuit can be filed to discharge student loans.